Auto Insurance Policies in Las Vegas Nevada

Liability Insurance Requirements in Las Vegas

Car insurance is actually a compulsory requirement for every car driver in Las Vegas, Nevada. The condition legislation demands every vehicle manager to possess an authentic insurance policy that deals with bodily injury and also property damage liability in the event that of an accident. Liability insurance assists protect the car driver, their passengers, and also every other person or vehicle associated with the accident. Opting for the best insurance coverage for your vehicle is a critical decision, as it guarantees financial protection in situation of unpredicted celebrations when traveling. Breakdown to abide with the insurance requirement can easily lead in charges, greats, or perhaps suspension of driving opportunities.

When buying car insurance in Las Vegas, vehicle drivers possess the option to decide on in between minimal liability coverage or even added comprehensive coverage. Lowest liability coverage supplies fundamental protection versus bodily injury and home damage caused through the covered by insurance driver in an at-fault accident. On the contrary, comprehensive coverage gives a broader variety of protection, featuring protection for damage dued to aspects including theft, criminal damage, or all-natural calamities. It is necessary for motorists to very carefully examine their insurance policy and also comprehend the protection delivered by their insurer to ensure they are properly protected while driving in the brimming city of Las Vegas.

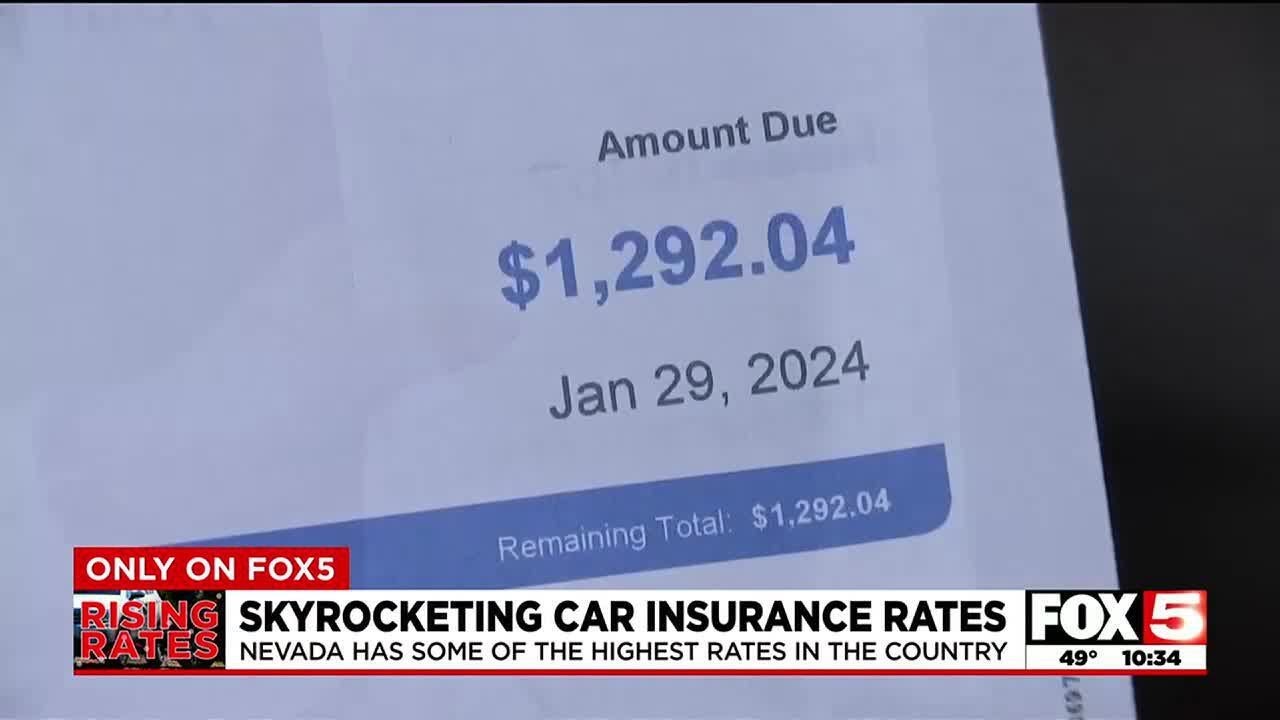

Just how much performs car insurance cost in Las Vegas?

Car insurance expenses in Las Vegas can easily vary depending on a number of aspects. Auto insurance companies in the location bear in mind a stable of variables when determining costs for vehicle drivers. These can easily feature driving record, coverage limits, bodily injury liability, property damage liability coverage, and also coverage options such as extensive and also accident coverage. The average cost of car insurance in Las Vegas is more than the national average, which can easily be credited to the distinct traffic conditions and driving routines in the city.

For teen vehicle drivers, the expense of car insurance may be dramatically higher because of their lack of knowledge on the road. In Las Vegas, insurance rates for teen drivers are actually influenced by factors like the type of vehicle they steer, their driving record, and also the quantity of coverage on their auto policy. It is actually advised for parents to look into different alternatives to locate affordable car insurance for their teen car drivers, such as packing insurance policies or putting in a telematics device to possibly lesser insurance rates. Providers like Geico give quotes that consider various variables to supply customized protection for drivers in Las Vegas.

Las Vegas car insurance discounts

In Las Vegas, auto insurance discounts can easily aid drivers conserve money on their insurance premiums. A lot of insurance providers offer rebates for several reasons like possessing a good driving record, being actually a student with really good qualities, or even packing numerous insurance plan all together. By making the most of these savings, motorists can easily decrease their auto insurance rates and also find cheap car insurance that matches their budget plan.

One more way to likely lower your auto insurance rate in Las Vegas is through sustaining continuous insurance coverage. Insurance provider commonly deliver savings to car drivers that have a background of dependable auto insurance coverage with no . Through revealing proof of insurance as well as illustrating responsible habits responsible for the wheel, drivers may receive lesser insurance premiums. In addition, some insurer might supply special savings for particular teams, including female vehicle drivers or students, so it deserves checking along with your insurance agent to view if you get approved for any type of extra financial savings on your monthly premium.

Typical car insurance in Las Vegas through rating factor

One key factor that affects the normal car insurance rates in Las Vegas is actually the kind of vehicle being covered. Insurance providers take note of the make, design, and age of the vehicle when identifying rates. For example, covering a deluxe sports car are going to normally possess greater costs compared to a common car. The amount of insurance coverage chosen also has minimum coverage an effect on the expense, with comprehensive coverage being much more pricey than standard liability coverage.

Another significant facet that influences typical car insurance rates in Las Vegas is actually the driving record of the insurance holder. Responsible vehicle drivers along with well-maintained driving reports are actually often entitled for safe vehicle driver discounts, which can easily result in reduced costs. On the various other hand, people with a history of incidents or traffic violations may face greater fees because of being actually regarded as higher threat through insurer. Moreover, grow older may also play a considerable job in insurance rates, as 20-year-old drivers are commonly looked at riskier to guarantee compared to a 35-year-old driver. Insurance carriers consider various variables like the rates of accidents entailing younger motorists, conformity along with teen driving laws, and total driving habits when determining premiums.

Why is car insurance in Las Vegas so expensive?

Car insurance in Las Vegas is especially expensive as a result of several providing factors. One substantial aspect is the eligibility requirements set through auto insurers, which can easily influence the cost of insurance coverage. In Nevada, minimum coverage requirements differ across metropolitan areas like Boulder City, Carson City, as well as Las Vegas, along with major cities usually establishing greater criteria. Furthermore, elements like financial strength ratings and also rating aspects can influence costs. It is necessary for motorists to think about elements including bodily injury liability, uninsured motorist coverage, and also underinsured motorist coverage when analyzing coverage levels, as these elements may substantially influence the general expense of insurance.

Additionally, the addition of extra attributes like anti-theft units and also seeking out markdowns, including those for full time pupils, can easily additionally determine the expense of insurance in Las Vegas Executing digital policy management devices and looking into possibilities for student price cuts may provide financial protection while potentially lowering premiums. Auto insurers in Las Vegas frequently servile sample rates on a variety of elements, including coverage levels and also individual situations. Through watching regarding fulfilling minimal demands and also exploring available discount rates, vehicle drivers in Las Vegas can easily look for ways to make car insurance a lot more budget friendly without weakening essential protection.

Bundling insurance coverage in Las Vegas

When it happens to packing insurance coverage in Las Vegas, insurance holders can unlock various discount opportunities by blending various insurance products under one supplier. This approach not merely improves the insurance method yet also usually causes set you back financial savings. In Las Vegas, insurance firms generally deliver discount rates for packing automotive and home insurance, allowing people to benefit coming from affordable rates while making sure comprehensive coverage all over several components of their lifestyle.

Aside from lesser annual premiums, packing insurance in Las Vegas may likewise simplify managerial duties by settling all policies in to one effortlessly obtainable electronic format. Whether it's dealing with a small fender bender or even evaluating coverage options, possessing all insurance info in one spot could be practical and also efficient. Additionally, packing can help avoid a lapse in coverage, making sure individuals have continuous protection throughout different insurance styles like bodily injury coverage, medical payments coverage, and additional coverages at the lowest rate feasible.

What are the liability insurance criteria in Las Vegas?

In Las Vegas, drivers are demanded to have liability insurance coverage of a minimum of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, as well as $20,000 for residential or commercial property damage.

The amount of does car insurance cost in Las Vegas?

The expense of car insurance in Las Vegas may differ relying on variables such as your driving record, age, the kind of cars and truck you steer, and the insurance company you opt for. Typically, vehicle drivers in Las Vegas spend around $1,400 each year for car insurance.

What are actually some auto insurance discounts offered in Las Vegas?

Some usual auto insurance discounts offered in Las Vegas include multi-policy discounts for bundling numerous insurance policies, safe driver discounts, as well as rebates for having anti-theft tools mounted in your car.

What is the ordinary car insurance in Las Vegas through rating factor?

The average car insurance in Las Vegas can easily vary through rating factor, but elements including age, driving record, and kind of cars and truck driven can all impact the cost of insurance.

Why is actually car insurance in Las Vegas therefore expensive?

Car insurance in Las Vegas could be much more costly than in various other locations because of factors such as a higher cost of collisions, theft, and vandalism in the city, and also the price of lifestyle and also insurance rules in Nevada.

How can bundling insurance plan in Las Vegas conserve loan?

Packing insurance coverage in Las Vegas, like combining your car and also home insurance along with the same supplier, may typically cause markdowns coming from the insurance company, inevitably aiding you save loan on your overall insurance prices.