Locate Your Perfect Car Insurance Coverage Strategy in Dallas

Variables to Consider Just Before Finding Car Insurance in Dallas

When picking car insurance coverage in Dallas, there are actually numerous vital elements to look at to locate the most effective protection for your requirements. Some of the main points to consider is actually analyzing your insurance coverage needs located on your steering habits, the value of your vehicle, as well as any type of prospective risks you may encounter on the roadway. It is actually important to comprehend the various types of car insurance offered, including responsibility, detailed, and accident coverage, to make certain that you possess the required security in position.

Researching insurance coverage providers in Dallas is yet another crucial action in picking the appropriate car insurance plan. Seek trustworthy companies along with a solid economic status and also a performance history of trustworthy customer care. Reviewing quotes coming from multiple insurance coverage business can assist you discover the best competitive fees, while reviewing customer reviews and also ratings may deliver valuable ideas in to the overall complete satisfaction amounts of insurance policy holders. Additionally, looking for rebates and also unique deals, reviewing policy limits and also deductibles, as well as speaking with an insurance broker for advice are actually all essential variables to think about when creating an informed decision regarding your car insurance strategy.

Analyzing Your Coverage Needs

It is actually vital to look at a couple of vital aspects when it comes to evaluating your protection requires for car insurance in Dallas. Evaluate the value of your vehicle and also just how a lot protection you would need to have in situation of an accident or fraud. Find out if you require complete coverage, wreck coverage, or merely obligation insurance policy based on your vehicle's worth and your finances.

In addition, think of your steering routines as well as the danger elements linked with the roads you frequently journey on in Dallas. You may prefer to decide for insurance coverage that features roadside aid or even rental car reimbursement if you have a long commute or frequently travel in high-traffic places. Recognizing your driving designs can easily aid you decide on the appropriate degree of insurance coverage to effectively secure on your own and also your vehicle.

Comprehending Various Kinds Of Car Insurance Coverage

It is actually necessary to comprehend the various types of policies available when it comes to choosing car insurance policy in Dallas. Obligation insurance policy is actually a legal criteria as well as deals with loss and personal injuries resulted in to others in a mishap where you are at error. It usually includes both physical injury obligation and also residential or commercial property damage liability insurance coverage.

One more typical kind of car insurance is actually accident insurance coverage, which aids spend for fixings to your personal vehicle after an accident with an additional car or things. Comprehensive insurance coverage, alternatively, safeguards versus loss to your car that are actually certainly not an outcome of a wreck, like theft, criminal damage, or natural disasters. Knowing these different plan choices can aid you choose the coverage that greatest meets your necessities and budget.

Researching Insurance Providers in Dallas

When investigating insurance suppliers in Dallas, it is actually vital to take into consideration a few vital variables to ensure you decide on a trustworthy as well as respectable provider. Beginning by checking the financial security of the insurance coverage supplier. A monetarily audio business will have the capacity to accomplish its own commitments to insurance policy holders, particularly throughout times of insurance claims.

Next, look at the client solution online reputation of the insurance suppliers you are actually looking at. Positive customer assessments and also rankings can give you idea right into how the firm manages claims, queries, and total consumer satisfaction. Additionally, looking into the provider's response opportunity and also performance in handling insurance claims may aid you evaluate their degree of company.

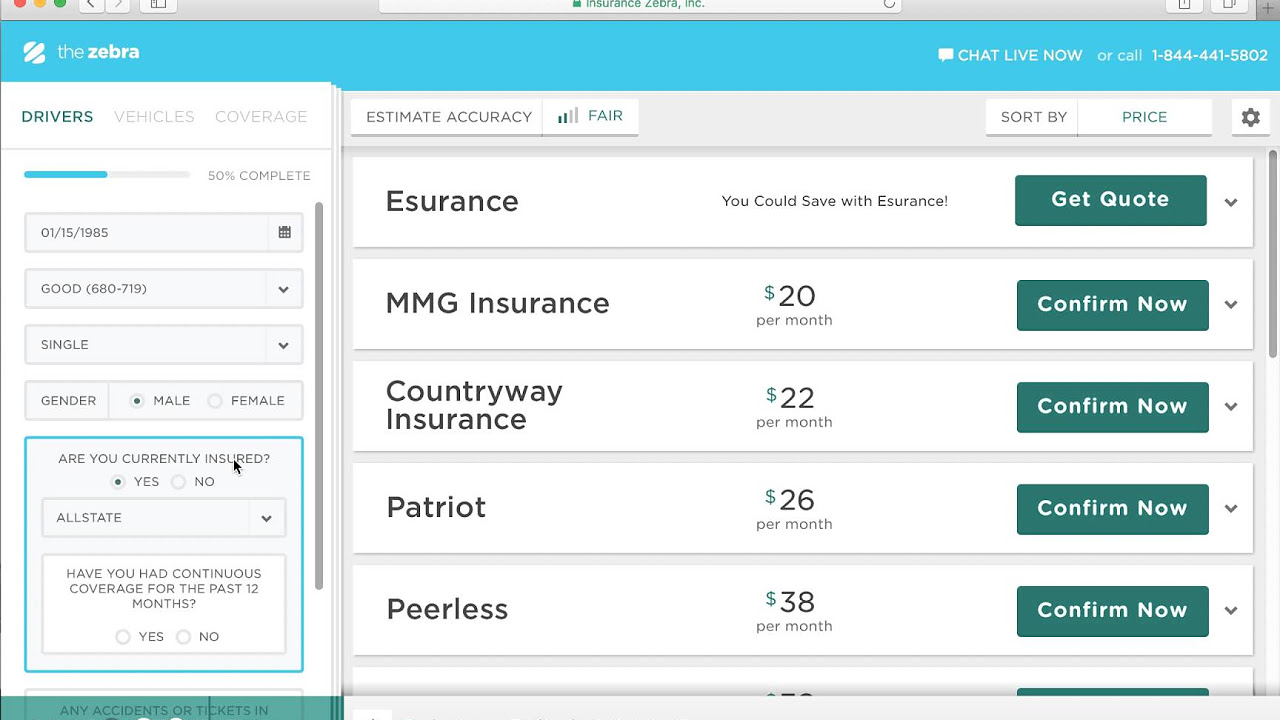

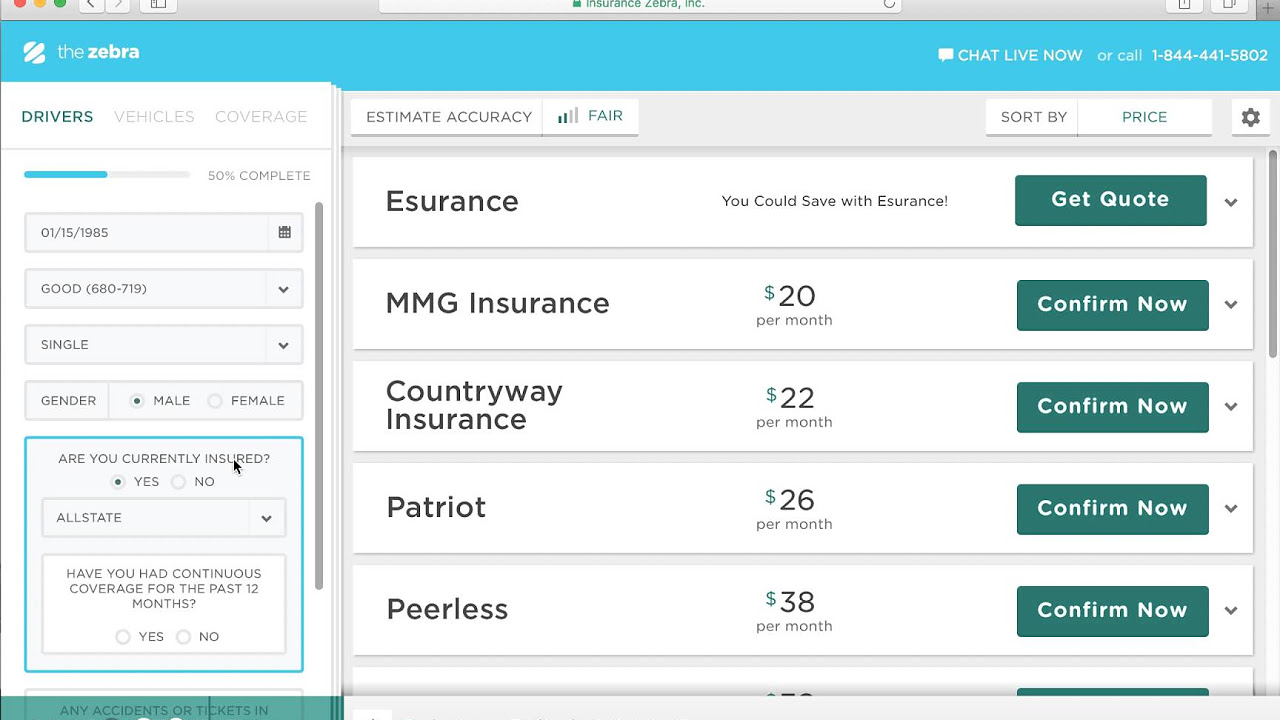

Contrasting Quotes from Various Insurer

When comparing quotes from various insurance policy business in Dallas, it is essential to take into consideration certainly not only the cost however likewise the protection each plan offers. Put in the time to thoroughly review the information of each quote, featuring the tax deductible amount, plan limits, and any sort of fringe benefits or even rebates offered.

Additionally, look at the reputation as well as economic reliability of the insurer. Search for testimonials and ratings from previous as well as existing clients to assess their degree of customer satisfaction and dependability. By reviewing quotes coming from multiple insurer in Dallas, you can easily create a well informed choice that satisfies your insurance coverage demands and also finances restrictions.

Analyzing Consumer Assessments and Scores

When thinking about different car insurance coverage alternatives in Dallas, reviewing consumer reviews as well as scores may provide useful understandings into the quality of service used by insurance service providers. These reviews are actually often composed through individuals that possess first-hand knowledge handling the firm, producing all of them a trusted resource of info for possible customers. Through taking the time to review client feedback, you can obtain a far better understanding of the provider's track record, customer support, and states methods.

Beneficial evaluations that highlight timely claim negotiations, practical customer support reps, as well as overall total satisfaction along with the insurance protection can suggest a trustworthy as well as trusted insurance provider. On the contrary, adverse testimonials that mention difficulties along with case handling, less competent customer support, or problems along with policy protection can work as indicator to prevent specific insurance provider. It is significant to look at the total consensus of client assessments as well as scores to make an educated choice on which insurance policy supplier is actually the finest fit for your necessities and inclinations.

Inspecting for Markdowns and Special Deals

When looking for car insurance coverage in Dallas, it is actually important to search for discounts as well as special deals that might aid decrease your premium expenses. A lot of insurance policy companies supply several price cuts like secure driver price cuts, multi-policy discounts, great pupil discounts, and also even more. Through making use of these promotions, you may potentially spare a substantial amount on your insurance coverage premiums.

It is vital to carefully assess the qualifications criteria for each price cut and also special offer to make sure that you certify. Some discount rates may require you to have a well-maintained driving report, put in security functions in your vehicle, or even package multiple insurance with the very same supplier. Through recognizing the certain requirements for every savings, you can easily maximize your financial savings as well as find the most ideal car insurance policy coverage that matches your budget and also necessities.

Reviewing Plan Restrictions as well as Deductibles

When examining plan limits and also deductibles, it is actually important to comprehend how they may impact your insurance coverage and expenditures in the occasion of an incident or even various other covered accident. Policy limits describe the maximum total an insurance business will certainly pay for an insurance claim. It's vital to select limitations that properly protect you fiscally without being extremely costly. Much higher limits generally indicate higher costs, however they can easily offer much better protection if you are ever before associated with a pricey incident.

Deductibles, however, stand for the amount you are demanded to spend just before your insurance policy protection pitches in. Picking a higher deductible may decrease your fees yet likewise means you will certainly possess to pay additional out of pocket before acquiring insurance coverage benefits. It is crucial to strike a balance in between a tax deductible you may pay for and a superior that fits your budget. Carefully examining policy restrictions and deductibles makes certain that you possess the correct level of coverage without being rippling off for insurance that you might certainly not need to have.

Consulting with an Insurance Agent for Support

Finding guidance coming from an insurance coverage agent can be actually hugely beneficial when it comes to navigating the complications of car insurance coverage in Dallas. An insurance broker may offer customized suggestions tailored to your special demands and also conditions. They have the knowledge to detail the complexities of various insurance, helping you recognize the insurance coverage options readily available and the corresponding prices. Through speaking with an insurance coverage broker, you can easily acquire useful insights that may aid you in creating a notified decision when deciding on a car insurance strategy.

Moreover, an insurance policy broker can easily aid you in examining your particular protection criteria based on variables including the make and model of your vehicle, your driving routines, and any added protection you may require. They may make clear any kind of complicated phrases or provisions in insurance, making sure that you are fully aware of what you are actually buying. By leveraging an insurance agent's knowledge as well as knowledge, you can easily simplify the process of obtaining car insurance coverage and also have assurance knowing that you possess comprehensive insurance coverage in location.

Making an Informed Selection on Your Car Insurance Strategy

When it happens to making an updated selection on Insurance Navy Brokers your car insurance plan, it is actually essential to properly evaluate your coverage needs as well as budget restraints. Take the time to evaluate the different kinds of car insurance coverage on call in Dallas and consider which ones straighten finest with your steering routines and way of living. Researching insurance coverage service providers in Dallas is also a significant step to guarantee you are opting for a reputable company along with a performance history of excellent client service and declares contentment.

Besides looking into insurance coverage providers, matching up quotes from various firms can easily help you locate the absolute most very competitive prices for the protection you need. Reviewing consumer evaluations and scores can deliver insight right into the adventures of various other insurance policy holders as well as offer you a much better understanding of the level of company you can anticipate. Inspecting for price cuts as well as special offers, as effectively as examining policy limits as well as deductibles, are actually additionally vital consider choosing the correct car insurance coverage prepare for your needs. Consulting along with an insurance representative for guidance may give personalized recommendations and help you browse any type of intricate plan particulars before creating your final selection.