Beginner-Friendly Gold Investment Strategies: An Expert Resource for New Investors

The investment process is complex sufficient to make lots of people unclear about how to proceed. For those who intend to accomplish security and growth in their financial investments profile ought to take into consideration diversity. The financial investment capacity of gold depends on its capacity to offer a safety shield from market instability while serving as a beneficial asset to manage threat. Including gold in your profile gives portfolio variety while safeguarding financial investments against inflationary pressures. The tried and tested performance history of gold makes it a sensible investment choice for individuals curious about securing their financial future. Gold will certainly work as your friend with the changes of the securities market journey. Using gold within your financial investment portfolio supplies protection from currency fluctuation threats. Investors with all degrees of experience can achieve stronger profile durability with the addition of gold.

Understanding Portfolio Diversification

Creating a different financial investment profile allows you to reduce risk while going after constant returns. This technique relies greatly on including gold assets right into your portfolio.Benefits of Expanding Your Investments

Investment diversity calls for distributing your funding throughout multiple property groups. This method decreases threat with a balance in between assets that choke up and those that show much better efficiency. Spreading your investments across several assets lowers the opportunity of major financial problems. Investments in bonds or products may help reduce losses when securities market values decrease. This technique makes it possible for steady monetary gains throughout your investment duration.Diversifying additionally uses versatility. Market problems and personal goals allow you to customize your investment strategy. You can capture arising investment potential customers while decreasing your threat exposure. Successful monitoring of a diversified profile needs expertise of your threat tolerance and decision-making abilities that make use of market motion information.

The Function of Gold in Diversification

Investors watch gold as a secure "safe haven" property. Gold preserves its worth in financial downturns whereas various other assets typically lose their well worth. Gold improves portfolio defense by supplying stability while shielding versus inflation and currency adjustments. The performance of gold normally stays independent of supply and bond market motions. The security of gold often tends to persist when stock and bond markets show high volatility. The unique performance of gold helps in maintaining portfolio balance and may reduce the total investment danger. Capitalists frequently select to dedicate a small part of their investment profile to gold. A well balanced appropriation to gold makes it possible for investors to delight in stable returns while remaining available to chances from various other financial investments. Attaining a diversified profile that stays resilient relies on comprehending how gold integrates with your financial investment technique.The Fundamentals of Buying Gold

Gold investments provide profile diversity in addition to defense against financial instability. Effective gold investment approaches call for expertise of several investment types and understanding of affiliated dangers.Types of Gold Investments

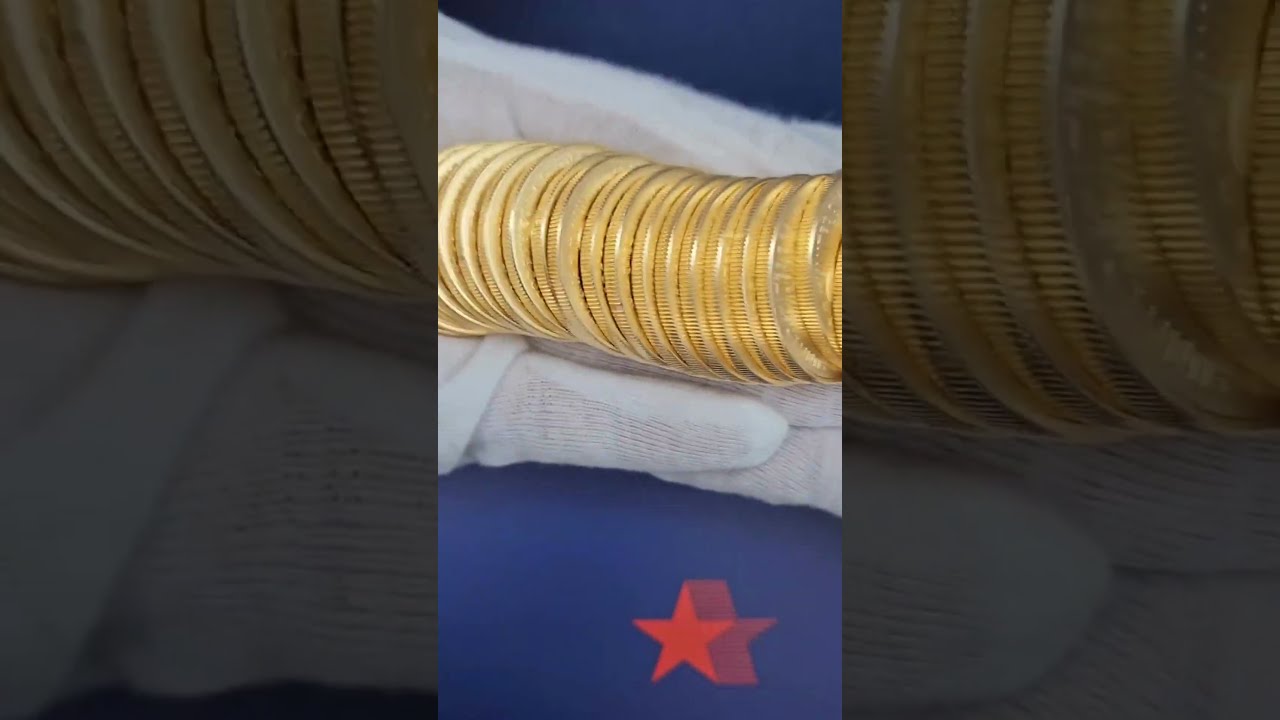

Capitalists can pick among various types of gold which each existing their own benefits and downsides. Physical gold consists of bullion, coins, and precious jewelry. The physical gold possession needs space for storage along with insurance policy security.Gold ETFs (Exchange-Traded Finances) are one more alternative. These funds monitor the price of gold while offering investors with a simpler financial investment method that doesn't need owning physical gold. Capitalists can trade Gold ETFs in a similar way to supplies while taking advantage of their lower management fees compared to a few other funds. Capitalists that wish to support mining companies can acquire gold mining stocks. The rates of gold mining supplies depend on a combination of market trends and company performance in addition to gold rates. Via gold futures and options you can guess on rates that will certainly exist in the future however these financial tools bring higher threats and demand specialized understanding. Different investment vehicles give distinctive approaches to take part in the gold market which call for analysis based upon your financial investment goals.

Gold Investment Risks

Financiers need to recognize the potential dangers associated with buying gold. Gold rates change because market volatility reacts to financial problems consisting of rising cost of living and rate of interest along with currency shifts. The costs of saving and insuring physical gold present economic challenges by increasing your overall expenditures.Liquidity is one more worry. Several gold investment alternatives existing troubles when offering quickly without experiencing economic losses. In futures trading counterparty danger matters due to the fact that you deal with potential losses if the various other event does not fulfill its legal responsibilities. Before making a financial investment choice understand these dangers and review them against possible advantages.

Strategies for Gold Investment

Gold financial investments can offer stability to your profile throughout unpredictable market problems. Financiers require to determine appropriate gold appropriation amounts and purchase timing as vital considerations for their investment strategies.Allocating Gold in Your Portfolio

The very first step to adding gold to your profile should be determining the quantity of your financial investment. Financial advisors frequently suggest that capitalists devote 5% to 10% of their overall investment portfolio to gold. Purchasing gold helps you minimize danger while taking advantage of its dependable performance throughout market instability. Assess your financial goals alongside your willingness to take threats. A bigger section of gold in a profile gives traditional capitalists satisfaction. Those who are prepared to accept greater danger degrees must take into consideration a minimized gold investment that works as a supplement to their stocks and bonds profile.Diversification is important. Gold financial investments provide protection from market variations and inflationary pressures. Capitalists should check out various gold investment choices consisting of physical gold holdings, ETFs and mining stocks. Each has its own risks and benefits. Physical gold exists in tangible form yet demands secure storage space approaches unlike ETFs which give exceptional liquidity.

Timing the Market

Successful gold investment calls for precise market timing. Economic elements consisting of rising cost of living and interest rates in addition to money strength reason fluctuations in gold rates. Keeping an eye on these signs will assist you determine prime purchasing chances in the market.Pay focus to geopolitical events. Capitalists flock to gold during times of economic instability and political tensions which press gold rates higher. Purchasing gold throughout unstable durations offers advantages to your investment portfolio.

Regularly analyze market fads and financial indications. Technical evaluation helps some investors spot market patterns by analyzing price charts. A different team of financiers pays very close attention to news and occasions which can influence gold costs. Investors can accomplish far better returns by purchasing properties when their prices are low and marketing them when rates boost.

Assessing Gold Investment Vehicles

Buying gold presents several options that have distinctive advantages and negative aspects. By discovering the readily available options you will be able to choose the most effective financial investment lorry that matches your technique and goals.Gold ETFs and Common Funds

Gold ETFs and shared funds provide accessibility to gold investments without requiring you to keep physical ownership of the steel. ETFs operate stock market comparable to supplies while they seek to duplicate gold's cost activities. ETFs provide both liquidity and uncomplicated acquiring and offering capacities which makes them an effective investment choice. Shared funds incorporate investments in physical gold with shares of business that operate in the gold field. This produces a more diversified technique. Examine fees and trading comfort as well as your preference for direct gold price exposure versus varied investments when picking between ETFs and common funds. Both financial investment paths give financiers with the possibility to hold gold in their profiles without needing to deal with physical gold possessions.Physical Gold vs. Gold Certificates

Physical gold purchases can include coins in addition to bars and jewelry options. Physical gold exists as a strong asset which you fully own. Physical gold provides you direct ownership yet needs protected storage space and insurance defense to take care of theft risks. Various other kinds of gold possession typically provide much faster liquidity than physical gold. Gold certifications allow you own gold without the requirement for physical storage space by representing it via monetary tools. Banks or various other institutions keep your gold to make possession easier. Certifications use boosted liquidity and conserve financiers from storage troubles which makes them interesting particular market participants. Assess just how comfy you feel concerning having physical possessions along with your storage ability and your requirement for fast financial investment accessibility. Your decision on whether to hold physical gold or to select certificates depends upon these factors.Managing and Monitoring Your Gold Investments

Maintaining healthy and balanced gold financial investments calls for consistent portfolio evaluation and rebalancing activities. Regularly checking your gold investments and making essential modifications guarantees your financial investment approach continues to be balanced.Reviewing Performance

Examining exactly how your gold financial investments carry out stands for a vital element of your economic oversight. Display gold cost variations and assess them versus your investment targets. Financial tools consisting of charts and historic data allow capitalists to track market fads.Pay interest to market news. Financial events often impact gold prices. Display gold price motions in reaction to stock exchange fads and adjustments in inflation rates and money worths. You make far better options by regularly checking out both historic and existing efficiency data. Choose unique durations for examining your financial investment performance. Routine reviews on a month-to-month or quarterly basis allow early detection of patterns and problems. Assessing your gold efficiency enables you to modify your approaches for achieving monetary objectives.

Rebalancing Your Portfolio

Profile rebalancing guarantees your financial investments remain lined up with your designated objectives. Considerable modifications in gold costs need you to modify your asset distribution to maintain your profile equilibrium. Select the ideal investment portion for gold to preserve profile balance. You must buy or sell possessions when gold occupies too big or too small a section of your portfolio to maintain balance. Staying disciplined in this procedure is key.

Timing is necessary. Ensure your portfolio continues to be lined up with your goals by rebalancing throughout considerable market adjustments and when your investment concerns change. Monitor economic indicator changes to comprehend their potential effect on your portfolio stability. A consistent rebalancing schedule helps reduce threats while enhancing long-term financial investment returns.